Unlock Your PotentialTM

Amaze Investment aims to transform businesses into market leaders.

About Us

Amaze Investment Est 2020

Amaze Investment is a private equity firm targeting investments in lower middle market companies. Since its inception in 2020, the firm has raised over $20M of capital commitments. In addition to supplying strategic growth capital, Amaze Investment leverages proprietary processes and services, to empower its portfolio companies to unlock their full business potential. The Amaze Investment is an operationally-focused value creation strategy, which includes management augmentation, operational initiative implementation, complementary business acquisition, sales and marketing improvements and leveraging technology and IP. The cornerstone of this strategy is Amaze Investment, its in-house technology team, which drives growth and value through digital marketing, e-commerce, big data and analytics, application development and internal and external platform optimization.

Investment Criteria

Industry Focus

- Business Services

- Consumer

- Industrial/Manufacturing

- Technology

Size Characteristics

- Revenue: $20 – $250M

- EBITDA: $5 – $35M

- Add–ons can be Smaller/Earlier Stage

Transaction Structure

- Preference for Control

- Private Companies or Divestitures

- Management Buyouts

- Shareholder Liquidity Events

Equity Strategy

- Enterprise Value: $50 – $500M

- Platform Equity Check Range: $25 – $250M

- Ample Capital Available for Add–ons

- Low Leverage: ~50 – 70% Equity

Amaze Investment

Sales & Marketing Improvements

We aggressively focus on gaining access to new markets, developing new products and instilling best of breed operational practices.

Strengthen Management

We strive to partner with superior management teams, supplement the team to support business needs and ensure we have a shared vision for growth.

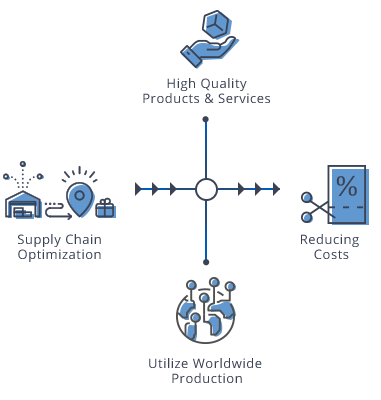

Operational Improvement

Reducing costs through supply chain optimization is critical to competing in the global economy. We seek to utilize worldwide production and labor forces as appropriate while maintaining the highest quality products and services.

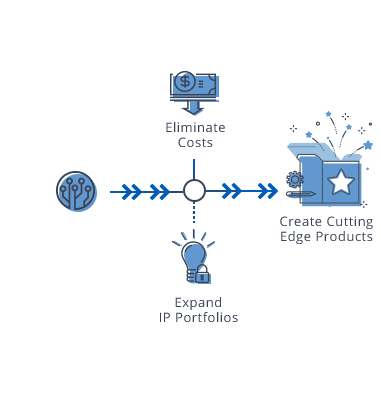

Leverage Technology & IP

With roots in venture capital, our team has significant expertise in applying technology to accelerate revenue growth, reduce operating costs and create cutting edge product and service offerings. When appropriate, we strategically invest in and expand intellectual property (IP) portfolios for our investments.

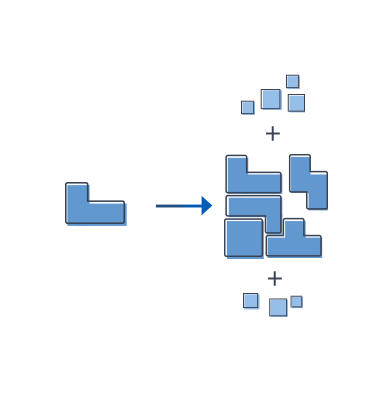

Add–on Acquisitions

Our buy & build approach is the foundation for our transformational growth initiatives. We target businesses that operate in fragmented markets where we can effect complementary and accretive acquisitions.

Amaze Investment is a team of uniquely skilled product strategists, software engineers, visual designers, online marketers, and social media experts. As a core Amaze function, they attain unparalleled alignment with portfolio companies' interests. The combination of aligned business purpose and Amaze Investment’ depth of experience results in technology enablement initiatives that are superior to what our portfolio companies were able to achieve prior to Amaze investment.